US dollar reverses losses as investors eye central bank speeches

( 3 min )

- Go back to blog home

- Latest

The US dollar regained a portion of its recent losses as markets opened for the week on Monday, with the dollar index up around half a percent on last week’s two month lows.

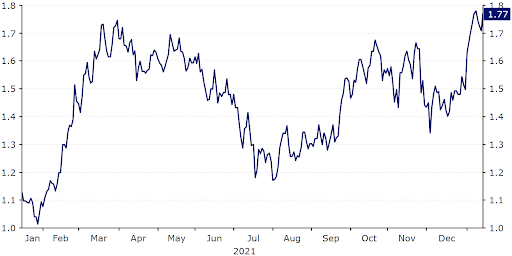

Figure 1: US 10-Year Treasury Yield (1 year)

Source: Refinitiv Datastream Date: 17/01/2022

We are, however, beginning to see signs of dissent among a handful of European Central Bank members, and that presents somewhat of an upside risk to the common currency. ECB President Lagarde said late-last week that the bank would take any measures necessary to bring inflation back down to target, while Vice President de Guindos has stated in the past few days that inflation is not as transitory as first believed. Signs of a growing chorus of hawkish dissent among council members in this Thursday’s ECB meeting will be hard for investors to ignore, as would a hawkish tilt from Lagarde during her speech on Friday. We will be paying similarly close attention to this morning’s ZEW economic sentiment survey, and Thursday’s revised Euro Area inflation data for December. Upside surprises in either could provide ammunition for a euro rally.

This week also looks likely to be a busy one in the UK, not least due to the ongoing dissatisfaction with Boris Johnson’s government for breaching lockdown restrictions during the height of the pandemic. November labour data (this morning), revised December inflation figures (Wednesday) and retail sales (Friday) make for a rather hectic week of macroeconomic news. Bank of England governor Andrew Bailey will also be speaking on Wednesday. Since the December interest rate hike, markets have been frantically pricing in a second rate increase from the BoE at its February meeting. Should Bailey pour cold water on another hike so soon, then sterling would sell-off sharply. We do, however, think that the opposite is far more likely, which could provide scope for a bit of a move higher in the pound in the second half of the week.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports