The pound rose to its strongest position versus the common currency since February 2020 on Wednesday after data showed that UK inflation jumped to its fastest pace in 30 years in December.

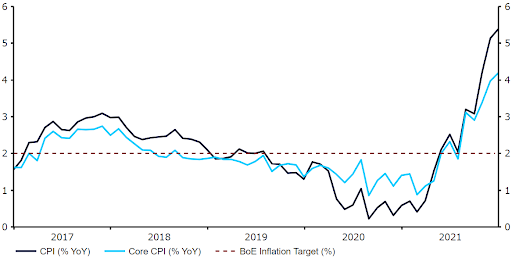

Figure 1: UK Inflation Rate (2017 – 2022)

The reaction among currency traders has been to send sterling higher against its peers. All yesterday’s data has done is confirm the market’s suspicion that the Bank of England will need to raise interest rates at a rather aggressive pace this year. Futures are now placing a near certainty of a hike in February, with 110 basis points priced in before the end of the year. BoE governor Andrew Bailey continued to stubbornly call some of the aspects of inflation ‘transitory’ during his speech yesterday, although he did raise concerns about tightness in the UK labour market and warn that the bank will do everything it can to control inflation. While Bailey has already proved himself to be a worthy successor to Mark Carney ‘unreliable boyfriend’ mantra, this rhetoric ought to all but confirm that another hike is on the way when the monetary policy committee next convenes early next month.

Focus in markets during the remainder of the week will likely be on the continued activity witnessed in global bond markets. Yields have surged higher across the board in the past few days, as investors ramp up bets that central banks around the world will raise interest rates at a rather aggressive pace in 2022. On the macroeconomic front, we will be keeping a keen eye on this morning’s Euro Area inflation print and the release of the ECB’s accounts from its December meeting this afternoon. Growing signs of dissent among Governing Council members in today’s minutes would further support our call that higher ECB rates may be on the way before the end of the year. Geopolitical concerns between Russia and Ukraine will also be worth keeping an eye on, although so far the tensions have not spilled into global financial markets to a particularly significant extent.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports