Safe-havens benefit as Ukraine headlines worsen

( 5 min )

- Go back to blog home

- Latest

Inflation and central banks have taken a backseat to geopolitics in financial markets, and currency markets are no exception.

The main macroeconomic releases on tap this week are the PMI advance indices of business activity in the US, Eurozone and the UK. However, the geopolitical crisis in Ukraine will probably overshadow them. It is not yet clear what impact a full on conflict would have on the EUR/USD exchange rate. While the dollar has traditionally been a safe-haven during crises, the rally in US yields that would likely ensue would knock off one of the supports underpinning the recent dollar rally.

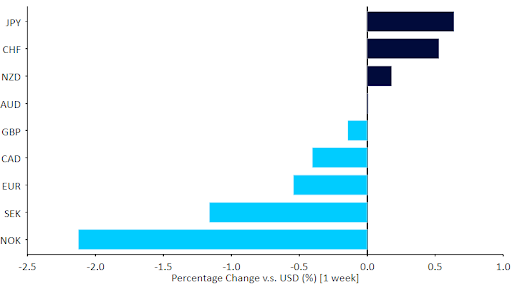

Figure 1: G10 FX Performance Tracker (1 week)

Source: Refinitiv Datastream Date: 21/02/2022

GBP

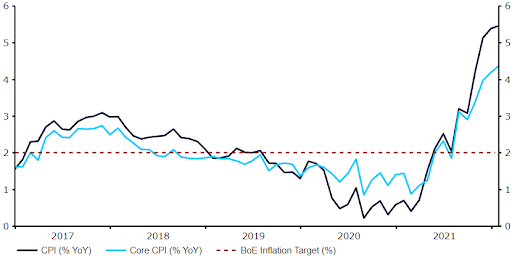

Almost every single inflation report from a major economic area has come out above expectations, in spite of the relentless ratcheting up of the latter. The UK last week was no exception. The headline rate inched up to a new multi decade record at 5.5%, with the core rate not far behind at 4.4%, signalling that inflationary pressures are spreading. The labour report and retail sales also surprised to the upside, lending support to the hawks in the Bank of England and hence to the pound, which held its own quite well in spite of the geopolitical deterioration.

Figure 2: UK Inflation Rate (2017 – 2022)

Source: Refinitiv Datastream Date: 21/02/2022

In addition to the PMIs of business activity, the docket this week is unusually busy with no fewer than six Bank of England MPC members scheduled to speak.

EUR

While ECB President Lagarde has continued to push back modestly against expectations of Eurozone hikes, her chief economist Lane appeared to back away from his extreme dovish views last week, finally acknowledging the possibility that the deflationary environment prevalent in the teens may never return.

This week´s PMIs may be overshadowed by the first February flash inflation data from France, which is almost certain to show further sharp increases. There is still plenty of room for markets to price in a faster schedule of hikes from the ECB, and we expect the common currency to be well supported as they do.

USD

This week will be a relatively slow one for US data releases, with just PMIs and PCE inflation on tap. Focus should remain on geopolitical headlines on one hand, and Federal Reserve communications on the other, with five Fed members slated to speak during the week. We wait for the uncertainty over the dollar reaction to a potential worsening of the crisis described above to be resolved soon.

Unlike other major economic areas, particularly the eurozone, it will be difficult for US rates to price much faster hikes than they already do, so there is scope for a partial unwind of the dollar rally against the euro.

CHF

The Swiss franc ended the week as one of the best performing G10 currencies as tensions over Ukraine grew in its second half. Concerns about a possible large-scale military attack by Russia increased after a series of negative signals from Eastern Ukraine, news about Russia amassing more troops near Ukraine’s border, and worrying claims from the US about an ‘imminent’ Russian invasion under a false pretext.

We continue to believe a key determinant of the franc’s behaviour in the short term is a Russia-orchestrated security crisis in Europe. It’s not our base case scenario, but it needs to be noted that a significant escalation, or indeed a Russian invasion of Ukraine, could push EUR/CHF to its lowest level since 2015.

AUD

Somewhat surprisingly, the Australian dollar outperformed last week, as commodity prices proved resistant in the face of geopolitical concerns. The Reserve Bank of Australia February meeting minutes showed that the central bank will be patient before raising interest rates, with policymakers noting that even if inflation had picked up, it was too early to conclude that it was sustainably within the target band. As stated in the minutes, “there were uncertainties about how persistent the pick-up in inflation would be as supply-side problems were resolved” and “wages growth also remained modest and it was likely to be some time before aggregate wages growth would be at a rate consistent with inflation being sustainably at target.” Members remained committed to maintaining highly supportive monetary conditions to achieve the objectives of a return to full employment and inflation consistent with the target (inflation sustainably being within the 2 to 3% target).

According to data published last week, Australia’s seasonally adjusted unemployment remained at a 13 year low of 4.2% in January, unchanged from a month earlier. With no major economic data due this week, AUD may be driven by events elsewhere.

CAD

The Canadian dollar ended last week close to the levels at which it started the week, after a volatile few days in which the currency benefited from rising crude oil prices but was hurt by geopolitical tensions.

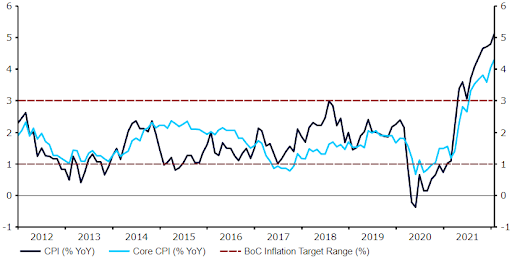

As we thought would be the case, Canada’s inflation surprised to the upside. January inflation accelerated to 5.1%, remaining at its highest since September 1991 and significantly above market expectations of 4.8%. Prices rose in all eight major components, as pandemic-related challenges continued to weigh on supply chains and energy prices remained elevated. On a monthly basis, consumer prices rose by 0.9%, exceeding market expectations of a 0.6% increase and recovering from a 0.1% decline in the previous month.

Figure 3: Canada Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 21/02/2022

CNY

The Chinese yuan edged higher against the US dollar last week, rallying alongside most of its emerging market peers.

The People’s Bank of China didn’t alter its key interest rates, in line with consensus. It did, however, inject more liquidity into the financial system by offering 300 billion yuan in one-year loans under its MLF – more than the 200 billion needed to roll over maturing securities. We can’t rule out further easing and will be closely watching retail sales, industrial production, and investments data for the first two months of the year when the statistical office releases the data in mid-March. The coming days are a rare period in which we will receive almost no economic data from China, hence we’ll focus on other topics and outside news.

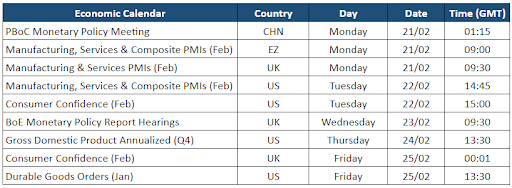

Economic Calendar (21/02/2022 – 25/02/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports