Trading in financial markets in the past 24 hours or so can very much be described as ‘risk off’, with a deterioration in risk appetite causing market participants to flee higher risk investments.

But what has triggered the worsening in risk sentiment in the past few trading sessions?

-

- Investors fret over Russia-Ukraine tensions. Financial markets had, for the most part, largely ignored headlines out of Russia and Ukraine in the past few weeks, although that is now no longer the case. Russia has continued to build up military on Ukraine’s border, with Nato allies putting forces on standby and scrambling ships and fighter jets to Eastern Europe in anticipation of conflict.Whether an invasion is actually on the cards or this is merely an elaborate tactic for Russia to get its way remains to be seen, but markets are not best pleased with the uncertainty that the ongoing tensions have created.

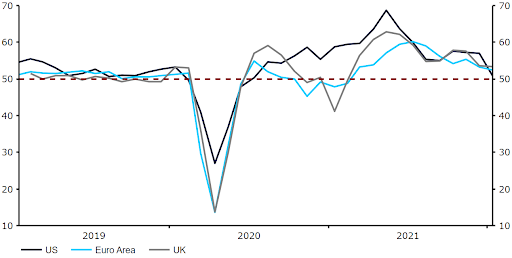

- Macroeconomic data takes a turn for the worse. While we are generally pretty positive about the economic impact from the omicron strain of COVID-19, we are beginning to see signs that the disturbance caused by the variant is clearly a non-negligible one.PMI data out of the G3 nations surprised to the downside on Monday. In the Eurozone, the composite index fell to an 11-month low 52.4 from 53.3, with the same index in the UK edging down to 53.4 from 53.6. Even more concerning was the collapse in the US composite PMI from Markit, which tanked to 50.8 from 57, barely above the level of 50 that denotes expansion (Figure 1).

Figure 1: G3 PMIs (2019 – 2022)

- Higher inflation, rates to weigh on the global economy? Global inflation data has continued to largely surprise to the upside in the past week, and that is fuelling concerns that higher prices could signal weaker growth ahead. In response, central banks are either raising interest rates, or indicating that hikes are on the way, and that is exacerbating concerns about the growth outlook.The Federal Reserve’s January meeting on Wednesday will be a key event risk for currencies this week. We don’t expect the Fed to raise rates until March, although the FOMC may spring a surprise by announcing an early end to its QE programme. This would likely cause the market to ramp up bets in favour of a 50 basis point move at the Fed’s next meeting, which could further weigh on risk appetite.

Macroeconomic data out today is relatively limited, so news on the ongoing Russia-Ukraine crisis will likely largely dominate the headlines, as will the market’s expectations ahead of Wednesday’s Federal Reserve meeting. As outlined in our FOMC preview report, we think that the bar for a hawkish surprise is high, so the dollar may find gains a little harder to come by than following recent Fed meetings.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports