Record high inflation heaps pressure on the ECB

( 3 min )

- Go back to blog home

- Latest

The dollar has recovered a bit of ground against its peers so far this week, with concerns over rising global inflation and some hawkish comments from FOMC members keep the safe-haven greenback well bid.

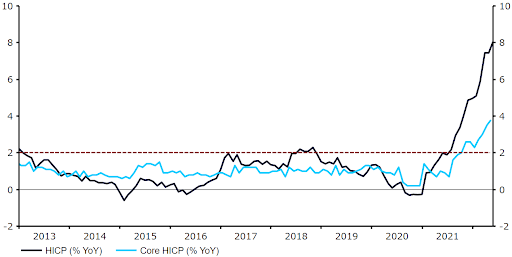

Figure 1: Euro Area Inflation Rate (2013 – 2022)

Source: Refinitiv Datastream Date: 31/05/2022

With prices rising at an aggressive rate, and activity data largely holding its own, it’s clear that the ECB’s highly accommodative policy settings are way out of whack with reality. Next week’s Governing Council meeting is almost certain to deliver a hawkish pivot, with markets eagerly awaiting details as to the possibile pace of policy tightening in the second half of the year. A first interest rate hike in July is now almost a done deal, with the real question to centre around the magnitude of the rate increase – 25 versus 50 basis points. Chief economist Philip Lane effectively confirmed this week that 25 bp moves in July and September would be the minimum, but the hawks in the council are likely to push for more, particularly given the strength of Tuesday’s inflation print.

Rising bets in favour of higher ECB rates has provided solid support for the euro of late, although we have seen a bit of an easing in the EUR/USD rally as investors again turn their attention to the impact of rising prices on global growth. This is favouring the dollar, which has risen against most of its major peers so far this week, including sterling. The pound has generally found gains hard to come by in the past month, in large part due to the cautious stance on rates adopted by the Bank of England. Expectations that the UK economy may also lag behind some of its peers through to the end of 2023 has also weighed on cable. Last week’s UK PMI figures, which massively undershot expectations, will be revised in the coming days. Barring any surprises here, we could see sterling trade in a relatively narrow range, given the Jubilee bank holiday will cut the trading week two days short.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports