FOMC March Meeting Reaction: Fed hikes rates, indicates 6 more in 2022

( 3 min )

- Go back to blog home

- Latest

The Federal Reserve raised interest rates for the first time in the pandemic era on Wednesday, while materially upgrading its expectations for both inflation and interest rates in 2022.

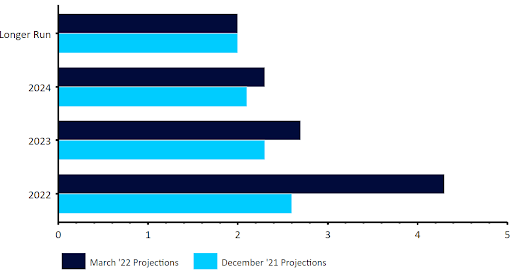

In its macroeconomic projections, the inflation forecast for 2022 was revised sharply higher. The bank now sees price growth ending the year at 4.3% versus the 2.6% anticipated in its last projections in December. Inflation is then expected to moderate to 2.7% in 2023 and 2.3% in 2024. Meanwhile, the growth forecast for this year was downgraded more than we had expected, perhaps an indication of heightened concerns over rising consumer prices and the ongoing disruption to global supply chains. That said, Powell sounded pretty optimistic during his presser, saying that the US economy remains ‘very strong’ and that improvements in labour market conditions were widespread.

Figure 1: FOMC Inflation Projections [March 2022]

Source: Refinitiv Datastream Date: 16/03/2022

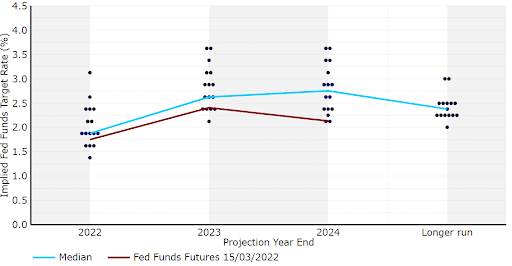

On interest rates, Powell repeated his line from January that every meeting this year was a ‘live’ one, with additional hikes seen as appropriate in order to ‘ensure that high inflation doesn’t become entrenched’. The big surprise was the extent of the upward revision to the bank’s ‘dot plot’ of interest rate projections. The median dot now indicates that FOMC members expect seven rate hikes in 2022, up sharply on the three anticipated back in December. This is also more aggressive than the five rate increases that we had expected the dots to show prior to the meeting, although it is more-or-less right in line with market pricing. Meanwhile, on the bank’s balance sheet, Powell noted that quantitative tightening plans could be finalised by the FOMC’s May meeting, which we see as relatively hawkish.

Figure 2: FOMC ‘Dot Plot’ [March 2022]

Source: Refinitiv Datastream Date: 16/03/2022

We think that the hawkish turn in the dot plot can largely explain the knee-jerk move higher in the dollar. The rally in the greenback was, however, fleeting, signalling perhaps that current levels already price in all the Fed tightening that can reasonably be expected in 2022. Fed fund futures were already pricing in a total of seven interest rate hikes in 2022, and today’s FOMC announcement merely confirms the market’s suspicion. With risks to US inflation firmly skewed to the upside, we expect the Fed to hike interest rates by another 25 basis points at its next meeting in May, with additional rate increases to follow at every meeting through to the end of the year.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports