ECB March Meeting Reaction: Hawkish ECB sets up 2022 rate hike

( 3 min )

- Go back to blog home

- Latest

The euro briefly rallied against its peers on Thursday after the European Central Bank announced that it was winding down its asset purchase programme faster than originally anticipated, despite the downside risks to growth posed by Russia’s invasion of Ukraine.

According to its statement, the Governing Council now expects to purchase €40 billion under APP in April, €30 billion in May and €20 billion in June, before concluding net purchases in the third quarter. This is not quite as aggressive of a reduction as we had anticipated prior to Russia’s invasion of Ukraine, although it is still a hawkish recalibration relative to the bank’s previous guidance. In December, it had expected to purchase €40 billion in the second quarter, €30 billion in the third quarter, and €20 billion in the fourth quarter in order to smooth the transition away from the PEPP, which will end as planned later this month.

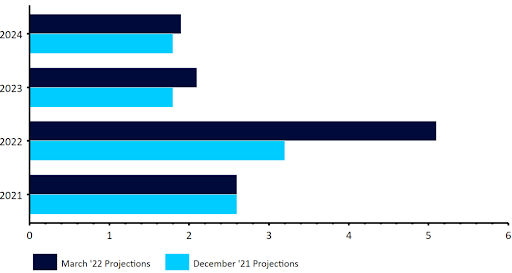

President Lagarde’s press conference was also hawkish. She said that supply bottlenecks were easing, the labour market was improving and that the economic recovery was boosted by fading covid risks. As expected, the bank’s inflation forecasts were shifted higher in response to the Russia-Ukraine conflict. Lagarde noted that inflation could be ‘considerably higher’ in the near-term, and that higher energy costs could drag down demand. HICP inflation is now projected to increase to 5.1% in 2022 (versus the 3.2% expected in December), 2.1% in 2023 (1.8%) and 1.9% in 2024 (1.8%).

Figure 1: ECB HICP Inlfation Projections [March 2022]

Source: Refinitiv Datastream Date: 10/03/2022

The downward revision to growth this year was, however, surprisingly small. ECB staff now see expansion of 3.7% in 2022 (down only 0.5 p.p from December), and 2.8% in 2023 (down from 2.9%). We see this as perhaps a touch on the optimistic side, particularly given the bloc’s heavy reliance on oil and gas imports from Russia. That said, in addition to the baseline forecasts, the ECB prepared two scenarios: ‘adverse’ and ‘severe’, in light of the uncertainty surrounding Ukraine.

These scenarios explore the possibility of stricter sanctions and a more pronounced reaction of the economy and markets. Under the ‘severe’ scenario GDP growth would be 1.4 p.p. below the baseline and inflation would be 2 p.p. higher, with the negative effects to be felt beyond this year.

Currency traders reacted to the bank’s hawkish surprise by initially sending the euro around half a percent higher versus the US dollar, although these gains were quickly reversed. We think that this is largely due to the perceived cautious tone on interest rates in the bank’s statement and Lagarde’s presser. In its statement, the bank noted that any adjustment in interest rates would take place ‘some time’ after the end of APP and would be gradual, with the bank dropping its previous pledge to raise rates ‘shortly after’ the conclusion of net purchases. That said, we don’t necessarily see this as a clear dovish signal – Lagarde herself noted that ‘some time’ could be as little as a week. We instead think that this tweak in guidance merely gives the ECB increased flexibility when it comes to raising interest rates, and it will take a more data-dependent approach, rather than a time-dependent one.

Figure 2: EUR/USD (1 week)

Source: Refinitiv Date: 10/03/2022

As alluded to in our ECB preview report, we think that the sharp increase in Euro Area price pressure made this hawkish turn an inevitable one, albeit it has come sooner than most investors anticipated. We think that today’s announcement gives the bank plenty of flexibility when it comes to normalising policy and, depending on the inflation outlook and developments in Ukraine, we see it as likely that the bank will provide further clarity on the APP end date at the next meeting in April.

While a June interest rate hike may perhaps be slightly too soon, we continue to think that the ECB will wind down its APP by September, at the very latest. This, we think, would pave the way for a first hike by no later than the bank’s 8th September meeting, possibly earlier, with another to follow in December. Markets are increasingly coming around to this view, with 45 basis points of hikes now priced in by the end of the year (up by approximately 10 basis points from before the meeting).

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports