Ebury Monthly Goods Trade Monitor: Trade with Latin America shows strong growth driven by surging imports of Peruvian LNG

( 3 min )

- Go back to blog home

- Latest

The second edition of the Monthly Goods Trade Monitor from Ebury uncovers growing imports of LNG from, and exports of machinery to, Peru as the country becomes increasingly important part of the UK’s global energy strategy.

The second edition of the Ebury Monthly Goods Trade Monitor reveals surging gas imports from Peru and exports of machinery to the country are driving increasing trade with Latin America, while the UK’s new trade negotiations with Mexico could also boost exports to the region.

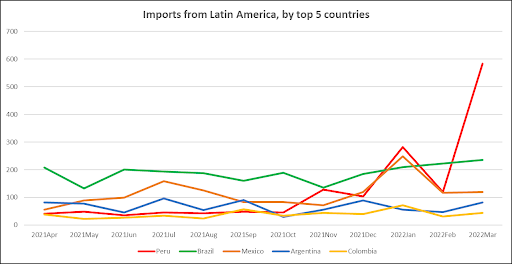

The ONS’ latest trade statistics for March 2022 show that imports from Latin America increased 71% compared to February 2022, with exports up 42% over the same period.

For the 12-months Apr’21-Mar’22, imports (26%) and exports (27%) were up by over a quarter compared to the year before.

Further analysis of these headline figures reveal Peruvian gas imports could be a major driver behind both trends.

The UK only imported a total of £80 million of gas from Peru between January 2018 and October 2021. However, it imported a further £1,089 million between November 2021 and March 2022, including £472 million in March 2022 – nearly 40% of the UK’s total imports from Latin America through the month.

Exports of machinery and transport equipment to Peru also surged in March rising to £95 million from a long-term average of around £5 million a month. With rising gas imports from the country, it appears the UK is deepening its ability to import LNG from Peru by supporting its investment in infrastructure.

Gas prices have been surging in Europe, exacerbated by fears over supply following Russia’s invasion of Ukraine at the start of the year.

Jack Sirett, Head of Dealing at Ebury, the global financial services firm which recently acquired the Brazilian fintech Bexs to deepen its ability to support companies trading in Latin America, said the findings revealed the UK’s desire to deepen its gas inventories ahead of next Winter and diversify its energy supply chain.

“On the face of it, the ONS’ latest data shows a striking increase in trade between the UK and the Latin America region. However, rising imports have largely been driven by a surge in the volume of LNG being imported from Peru, while exports to the region were driven by rises in the exports of machinery to Peru and of fuels to Colombia.

The war in Ukraine has seen many European countries re-evaluate their gas supplies, and the UK has seen high volumes of LNG imported from the US, Qatar and Algeria alongside Peru. The recent expansion of the Panama Canal has improved the ability for Peru to export LNG to Europe, and for the UK it is a now comparable distance to Qatar meaning it could become an increasingly important trading partner.

We are also starting to see an increased appetite for businesses in the UK to look further afield and trade with countries in Latin America, especially in Brazil and Mexico as gateways to the region. Trade with these countries remains relatively limited in global terms, but we expect this to improve especially with the government starting to negotiate a new free trade deal with Mexico to boost exports of business services and goods, such as electric vehicles and Scotch whisky.”

Media enquiries:

Temple Bar Advisory

Alex Child Villiers / William Barker / Sam Livingstone

[email protected]

07827 960151 / 07769 65543