In a somewhat puzzling development, the dollar is struggling so far in 2022 even as US Treasury yields surge higher and the market prices in a faster hiking cycle from the Federal Reserve.

Inflation newsflow continues to dominate financial market sentiment and headlines, including the UK (Wednesday) and Japan (Friday). There are a slew of central bank meetings as well. Data flow out of the US and the Eurozone is quite light this week, but the market will be focused on a key speech by ECB President Lagarde on Friday on the global economic outlook, where she is expected the address mointing market doubts on the ECB’s ability to wait until 2023 before hiking rates as inflation surges globally.

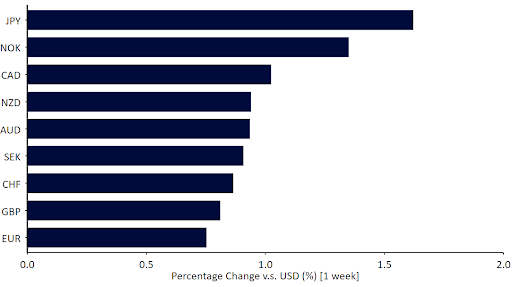

Figure 1: G10 FX Performance Tracker (1 week)

GBP

Markets largely ignored the political turmoil around Boris Johnson’s staff parties during quarantine, and focused instead on the strong November GDP data. Interest rate futures are already pricing in 4 additional Bank of England hikes during 2022, which largely explains Sterling’s scorching rally so far this year.

In a week full of key data releases in the UK, market focus will be on the inflation data, where another print above 5.0% is expected in the headline number. The labour market report for November on Tuesday will also be in focus, although it will be clouded by the short-term impact of omicron-related restrictions.

EUR

In a week without much in the way of meaningful economic data, the euro floated upwards versus the dollar in line with other G10 currencies, a move that we think was driven almost entirely by broad dollar weakness.

This week’s schedule also looks rather light, with a significant exception: President Lagarde’s speech on the global outlook on Friday. The gap between Lagarde’s dovishness on one hand and inflation numbers and market expectations on the other, grows by the week, and we expect her to use this opportunity to address it and clarify the ECB’s stance on future interest rate hikes. We expect volatile trading around the speech release.

USD

Even as expectations for US inflation ratchet upwards, the actual data rises even faster. December headline inflation printed 7% (Figure 1), the highest in four decades, and the core data is not far behind at 5.5%, its highest level since the early 1990s.

The calendar this week also looks light in the US, as the Fed enters its quiet period ahead of its next policy meeting on 26th January meeting. The main news so far in 2022 has been the decoupling between rate hike expectations, where the market now expects a total of four hikes in 2022, and the dollar, which continues to struggle against all its major peers.

Figure 2: US Inflation Rate (2012 – 2022)

CHF

After jumping above the 1.05 level to reach its highest level since late-November at the start of the week, EUR/CHF gave up all of its gains. Volatility in the pair has been rather high and news concerning the ongoing spread of omicron, worrying headlines regarding Russia, and the recent move higher in EUR/USD certainly haven’t helped to calm the market.

We’ll continue to focus on outside news as this week’s economic calendar for Switzerland is quite light and thesteep increase in new Covid cases in Switzerland doesn’t seem to be having a significant impact on the franc.

AUD

The Australian dollar rallied to an 8-week high near 0.731 versus the USD last week, as the greenback was under pressure after US inflation data came in line with expectations. November retail sales data published last week also benefited AUD, as retail sales jumped by 7.2% in November, exceeding market forecasts. However, the Australian currency fell by around half a percent versus the USD on Friday, largely due to concerns surrounding the spread of omicron in the country. New South Wales is seeing unprecedented numbers of COVID-related deaths, and businesses are struggling to stay open amid quarantine-related labour shortages and as customers become more cautious about attending social activities.

December employment data, which will be published on Thursday, will be the main economic release for the Australian dollar this week.

CAD

CAD ended last week trading at the highest level in two months versus the US dollar, below the 1.25 level, and the currency remains one of the best performers in the G10 so far in 2022, alongside sterling. With no major domestic economic data released last week, CAD strengthened on the back of a weaker dollar and higher oil prices, which rebounded sharply to above $84 per barrel, the highest in over two months.

December inflation data, set to be published on Wednesday, will be the most important economic data release for the Canadian dollar this week. We will also be paying close attention to Friday’s November retail sales data.

CNY

Contrary to market expectations, the Chinese yuan has appreciated so far this year, edging closer to its recent highs against the US dollar. That does, however, seem to be largely a consequence of a weaker dollar rather than the yuan’s renewed strength. Recent news about the first local omicron cases detected in a number of important cities including China’s capital, Beijing, and some new restrictions have brought to light downside risks to the economy as the country sticks to its zero-Covid policy. While China’s GDP expanded by only 4% year-on-year in the fourth quarter, as per today’s data, growth was stronger-than-expected. GDP expansion of 8.1% in 2021 is certainly decent, but this year’s growth looks set to be considerably slower.

To counter the slowing economy, China’s central bank has taken a number of steps towards easing policy, with the latest ones announced today. The one that made headlines was an unexpected 10 basis point cut to the 1-year Medium-Term Lending Facility rate to 2.85%, which was the first such move since April 2020. Attention now turns to Thursday, when the bank will set the 1- and 5-year loan prime rates. Although most economists didn’t expect a cut to LPR this week, today’s MLF rate cut means an adjustment is now likely. Last week’s inflation data showing both consumer and producer prices growing slower than expected in December means the bank may not hesitate to act.

Economic Calendar (17/01/2022 – 21/01/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports