What’s going on in China in May and to expect from RMB?

( 5 min )

- Go back to blog home

- Latest

The Chinese yuan was one of the best performing currencies worldwide up until very recently.

Market Update

The future of the yuan will largely depend on the country’s success in battling the virus. Shanghai’s outbreak seems to be close to being contained, but Beijing has tightened restrictions, as is on the verge of lockdown. The currency remains pressured lower by internal issues, as well as a relentless US dollar rally. That said, it did receive some help from the PBoC, after the bank set a stronger-than-expected fixing. This is another indication that the central bank may not want to see the currency weaken too rapidly.

China could cushion the blow with more monetary policy easing, although the PBoC appears reluctant to engage in strong and broad steps. The rate on the 1-year Medium-Term Lending Facility was left unchanged and the bank rolled over maturing loans. The bank’s cautious approach is possibly a response to the yuan’s weakness and an increase in inflation. Last week’s data showed that consumer prices grew 2.1% in April, beating consensus.

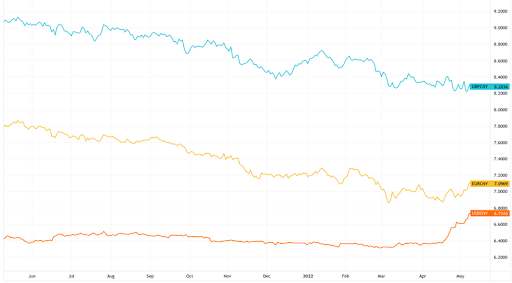

Figure 1: CNY vs. G3 currencies for the last 12 months

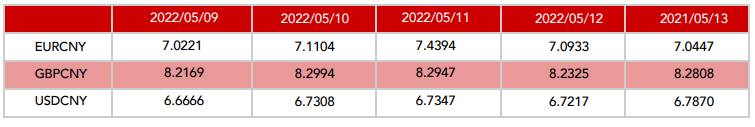

Buy CNY Spot Rate for week 1 - 7 May 2022

PBOC Unveils 23 Measures in Latest Bid to Revive China’s Economy

04/19/2022*

China’s central bank rolled almost two dozen measures and promises intended to boost lending and support industries that have been battered by recent Covid outbreaks and lockdowns.

The 23 steps include everything from lending guidance for banks and promises to make it easier for companies to expand the cross-border use of the yuan, to general pledges for more credit or other financial support.

Here are the specific measures of foreign exchange in the document:

- It will make it easier for companies to borrow from overseas

- It will further digitize cross-border bank settlement and payment services

- It will step up insurance support for small exporters and importers.

- It will encourage companies to use more yuan to settle cross-border trade, and enhance foreign exchange derivatives so firms can better prevent risks.

- It will enhance procedures and standards to make it more convenient for foreign investors to invest in Chinese securities markets.

China’s Politburo Ignites Market Rally With Vows on Growth

04/29/2022**

China’s top leaders promised to boost stimulus and contain the country’s worst Covid outbreak since 2020, issuing a sweeping set of pledges that was light on details but enough to spark steep gains in stocks and the yuan.

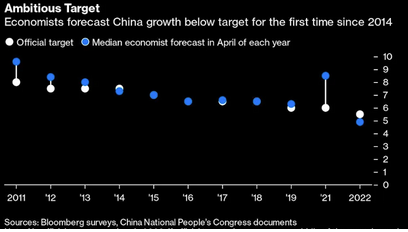

The Politburo’s commitment to meeting its growth target of about 5.5% for the year despite the Covid upheaval suggests stronger stimulus measures may be on the cards, including a ramp up in infrastructure spending .

“Covid must be contained and the economy must be stabilized,” the Politburo, led by President Xi Jinping, said “We should waste no time in planning more policy tools and enhance the strength of adjustment in due course.”

The timing of the statement during market hours was unusual, helping equities, corporate bonds and the currency rally into a long holiday weekend after steep losses earlier this month.

Source Bloomberg

RMB Case Study

Background

A German company specialising in home electronics, works with 25 different suppliers in China.

Client has been paying its Chinese suppliers in US dollars and euros. However, in his last order in January, he noticed an increase in prices from the suppliers. Price increases were mainly arising from the worsening USD/CNY, EUR/CNY exchange rates, making it challenging for the Chinese suppliers, whose production and operating costs are all in their local currency CNY.

Tailor made FX solution to cater for client and suppliers needs

The client discussed this issue with his Ebury’s Account Manager, who recommended him switching to payments in suppliers’ local currency, Chinese yuan. Ebury’s team of Mandarin-speaking foreign exchange experts assisted the client in the discussions with the suppliers and got his 11 main suppliers to switch to RMB, out of those some suppliers wanted to stick to receiving USD although giving prices in RMB, due to different reasons including complicated bank procedures, existing business practice and loss of government subsidies.

Ebury’s account manager offered the client a parallel forward solution to protect against the risk of negative movements in EUR/CNY exchange rate whilst allowing suppliers the flexibility to continue receiving USD.

Paying in RMB saves money for foreign trade based SMEs

As the RMB continues to internationalise, more and more companies are using RMB for cross-border trade settlement to protect themselves against foreign exchange risk.

In the last few years more businesses are switching to RMB payments, in this case the client was able to save 1.5% – 2% due to the increasing appreciation of the RMB.

On the supplier’s side, by providing direct pricing in RMB, they avoid previous cost instability happening again caused by the fluctuating exchange rate of US dollar – euro. This way, both sides win.

Feedback from the client

I am very satisfied with the cooperative nature of our relationship, and I am happy to say it will last into the long term.

The service is fast and helpful – whether by mail or by phone, you can always reach someone if you have a problem. The personal quality of a business relationship is important to me, and Ebury delivers in spades. Business-wise, we of course benefit in the long run from the good rates we can secure.

This was unfortunately not the case before, but with high purchase values in third party countries, we are now saving an enormous amount of money and enjoying real financial flexibility in our trade finance.

* https://www.bloomberg.com/news/articles/2022-04-19/pboc-unveils-23-measures-in-latest-bid-to-revive-china-s-economy

** https://finance.yahoo.com/news/china-politburo-pledges-more-stimulus-051513733.html